Ethereum, the second-largest blockchain, powers countless decentralized applications, but its gas fees have always been a point of contention. Recently, a surge in these fees has caught widespread attention, linked to the explosive growth of AI-driven blockchain gaming. This trend has pushed network activity to new heights, amplifying competition for transaction processing. High demand for blockchain gaming is straining Ethereum’s network, leading to increased costs for users. In the sections ahead, we’ll break down the factors driving these fee surges and explore what this means for the future of Ethereum.

The Basics of Ethereum Gas Fees

Ethereum gas fees play a crucial role in keeping the blockchain operational and efficient. Without gas fees, the Ethereum network would face congestion, instability, and other inefficiencies. These fees ensure transactions are processed and validated in a secure, decentralized manner. But how does it all work? Let’s break it down.

What Are Ethereum Gas Fees?

In simple terms, Ethereum gas fees are transaction fees paid by users to compensate network participants for the computational resources required to process and validate their transactions. Gas is essentially the unit that measures the amount of computational effort required for an operation. Whether you’re making a simple ETH transfer, minting an NFT, or interacting with a smart contract, every action consumes gas.

Gas fees are paid in gwei, a small unit of Ether (ETH). One ETH equals 1 billion gwei. This system ensures that minor fees can be handled without extensive decimal values, which would be challenging to work with.

How Are Gas Fees Calculated?

The total Ethereum gas fee is determined by multiplying three components:

- Gas Limit: This is the maximum amount of gas you’re willing to spend for a transaction. Each type of operation has a specific gas requirement. For example, sending ETH typically requires 21,000 gas units.

- Base Fee: The base fee is an algorithmically determined minimum fee that adjusts dynamically based on network activity and demand. This component was introduced with Ethereum’s EIP-1559 upgrade to increase fee predictability.

- Priority Fee (Tip): This optional fee is paid to miners (or validators in Ethereum’s Proof-of-Stake system) to prioritize your transaction. It can be seen as a “fast pass” in case you need quick processing.

The formula for calculating gas fees is:

Total Gas Fee = Gas Limit × (Base Fee + Priority Fee)

For a quick example, let’s say the base fee is 50 gwei, and the priority fee is 15 gwei. For a simple ETH transfer requiring 21,000 gas units, the formula would be:

21,000 × (50 + 15) = 1,365,000 gwei (or 0.001365 ETH).

Why Are Gas Fees Important?

Gas fees guarantee that Ethereum remains secure and decentralized by incentivizing validators or miners to process transactions. Without these fees, there would be little motivation for participants to dedicate computational power to the network. Furthermore, high fees during peak activity ensure that only users willing to pay more can prioritize their transactions, preventing the network from becoming entirely unusable when overwhelmed.

However, the downside is that these fees can make transactions prohibitively expensive for everyday users, especially during network congestion or high-demand periods. This issue has been a major challenge for Ethereum adoption.

Innovations to Reduce Gas Fees

To tackle high gas fees, Ethereum and its ecosystem have introduced several innovations:

- EIP-1559: This upgrade split gas fees into base fees and priority fees. The base fee gets burned, reducing ETH supply and improving fee transparency.

- Layer-2 Solutions: Technologies like Optimistic Rollups and ZK-Rollups process transactions off-chain and submit proofs back to Ethereum, drastically reducing fees.

- Upcoming Upgrades: Ethereum’s future updates, such as sharding, aim to further boost network scalability and efficiency, making gas fees more affordable for users.

Understanding gas fees is crucial for anyone looking to engage with Ethereum. These fees not only keep the network running but also reflect the growing demand for blockchain-based technologies like AI gaming and decentralized finance.

The Role of AI Gaming in Increasing Network Demand

The surge of innovations in blockchain-based AI gaming has created a new wave of network traffic. Ethereum, with its robust infrastructure and widespread adoption among developers, has become the preferred home for many of these projects. However, this popularity comes at a cost—as activity increases, so do Ethereum gas fees, directly influencing user experiences and the network’s scalability.

The Rise of AI-Powered Blockchain Applications

AI-powered blockchain applications are reshaping how users interact within decentralized networks. On Ethereum, AI tools are being integrated into gaming ecosystems to deliver intelligent gameplay, autonomous decision-making, and 24/7 operations. These applications are not just advanced; they are highly interactive and computationally intense. Platforms like Immutable, a layer-2 scaling solution for Ethereum, and game developers using AutoGPT AI gaming models push the current limits of what is possible on the blockchain.

Decentralized applications (dApps) like GOAT Gaming, with autonomous agents capable of competing in tournaments around the clock, are examples of this trend. Sometimes referred to as “player-less gaming,” AI bots engage continuously, competing, earning token-based rewards, and interacting with smart contracts. It’s a revolutionary model that redefines user engagement, yet each interaction necessitates transaction validation through Ethereum’s blockchain infrastructure. Multiply this by tens of thousands of participants, and the network activity starts to reach critical mass.

In addition to gaming, broader AI-based platforms such as Olas allow users to configure autonomous agents for other tasks like trading or voting within decentralized governance systems. These systems interact with Ethereum by continually generating transactions—each one consuming computational resources, leading to inflated gas fees.

As AI agents become more ubiquitous within blockchain ecosystems, Ethereum is experiencing increased strains due to rising data consumption. Whether it’s complex smart contract executions or simple transactions initiated by AI activity, the cumulative effect is overwhelming networks—and users are paying the price.

How Gaming Smart Contracts Strain the Network

At the heart of these AI-enhanced blockchain games lie smart contracts. These are self-executing contracts with predefined rules governing the interactions between parties. In gaming, smart contracts facilitate everything from minting in-game assets, processing player rewards, enabling NFT trade, and more. However, the complexity and frequent activity of gaming-related smart contracts pose a burden on Ethereum’s processing capacity.

Consider AI-driven NFT-based games. These ecosystems involve thousands of micro-interactions per minute, such as gameplay triggers or marketplace transactions. Games like Dawgz AI, for instance, generate immense on-chain activity as players compete and trade items. Each of these interactions requires computational resources from Ethereum miners or validators, which drives congestion. When the network reaches its limits, gas fees spike to incentivize prioritization, resulting in higher costs for all users.

Additionally, gaming platforms often trigger cascading effects. For example:

- Mass participation spikes: When a game launch or event promotes widespread interest, transaction volumes soar quickly.

- Tokenized rewards: Real in-game rewards anchored by Ethereum can lead to speculative trading, further increasing activity.

- Frequent updates: Games leveraging AI often adapt rapidly, requiring ongoing contract updates and adjustments.

Every transaction, whether small or large, needs to be validated. The interaction-heavy nature of gaming contracts amplifies the intensity of Ethereum’s already-saturated network operations. When these operations reach a tipping point, they create a bottleneck, leading to sharp increases in gas fees that ripple throughout the ecosystem.

While layer-2 solutions, such as Optimism or Arbitrum, aim to mitigate this strain by offloading some activity, not every project has adopted these technologies. As a result, the Ethereum mainnet remains the battleground for much of the competitive gaming traffic, exacerbating systemic congestion.

Broader Market Trends Contributing to Gas Fee Hikes

The rapid surge in Ethereum gas fees isn’t just a product of increased AI gaming activity. Current market trends reveal that additional sectors, such as the rising popularity of memecoin transactions and a resurgence in decentralized finance (DeFi), are creating network congestion. Combined, these elements dramatically heighten demand on the Ethereum blockchain, escalating gas fees further.

The Surge in Memecoin Transactions

Memecoins, known for their speculative nature and viral appeal, have become a dominant force on Ethereum. Chaotic trading frenzies around popular tokens like Shiba Inu and others create enormous spikes in transaction volumes. As traders rush to buy, sell, and interact with these tokens, Ethereum’s network reaches capacity.

These spikes in activity often lead to a “first-come-first-serve” situation, where users willing to pay more get their transactions prioritized. This bidding war for transaction inclusion inflates gas prices to extraordinary levels. For instance, during memecoin launches or viral trading peaks, it’s not uncommon to see average gas fees shoot up by hundreds of percentage points.

Adding to the challenge is the unpredictability of the memecoin market. Since much of the activity is driven by hype and investor speculation, sudden bursts in transaction volumes can happen without warning. This volatility amplifies the strain on Ethereum, with traders competing in real-time for blocks that can only hold a limited number of transactions.

Another layer to consider is bot activity. Automated bots programmed to exploit small pricing inefficiencies in memecoin markets often submit thousands of micro-transactions per second, intensifying competition for network resources. This algorithmic trading contributes significantly to congested blocks and inflated fees.

DeFi Revival Amid Scalability Challenges

The DeFi sector has also been making a comeback in recent months, further straining the Ethereum network. After a period of stagnation, decentralized finance platforms like Uniswap, Aave, and Curve are seeing renewed interest. Borrowing, lending, staking, and yield farming are all back in popularity, and these activities rely on highly complex smart contracts that devour significant computational power.

One major trend is the growth in newer liquidity pools and staking programs offering high annual percentage yields (APYs). These platforms attract a flood of users, each performing multiple on-chain transactions for deposits, withdrawals, and token swaps. Every single interaction adds to Ethereum’s already overflowing capacity.

Additionally, the rise of innovative DeFi strategies, such as cross-platform yield optimization and on-chain derivatives, increases transaction complexity. These advanced financial instruments often require multiple layers of smart contract interactions, from collateralization to liquidation mechanisms and payouts. While they unlock new opportunities for users, they also come at the expense of higher gas requirements.

The correlation between the DeFi revival and gas fee spikes is evident in platform statistics. Decentralized exchanges (DEXs), a core component of DeFi, reported transaction volumes exceeding billions daily during peak periods. Every token swap, liquidity deposit, or withdrawal competes in the same congested Ethereum ecosystem, leaving no room for error when network traffic surges.

Layer-2 solutions, while helpful, cannot fully mitigate DeFi’s impact. Although protocols like ZK-Rollups or Optimistic Rollups are trying to scale operations, a significant portion of DeFi activity still occurs on Ethereum’s mainnet due to its depth of liquidity and compatibility. Combined with the activity from memecoins, DeFi growth ensures Ethereum remains consistently overloaded.

Proposed Solutions and Future Outlook for Ethereum Scalability

Ethereum’s scalability issues have long been a point of discussion in the blockchain and crypto community. As gas fees climb due to increasing network demand—driven in part by AI gaming platforms, memecoins, and DeFi applications—developers and researchers are racing to implement solutions. These include advancements in Layer 2 scaling technologies and Ethereum Improvement Proposals (EIPs) focused on reducing congestion and cost. Here’s a comprehensive look at these developments.

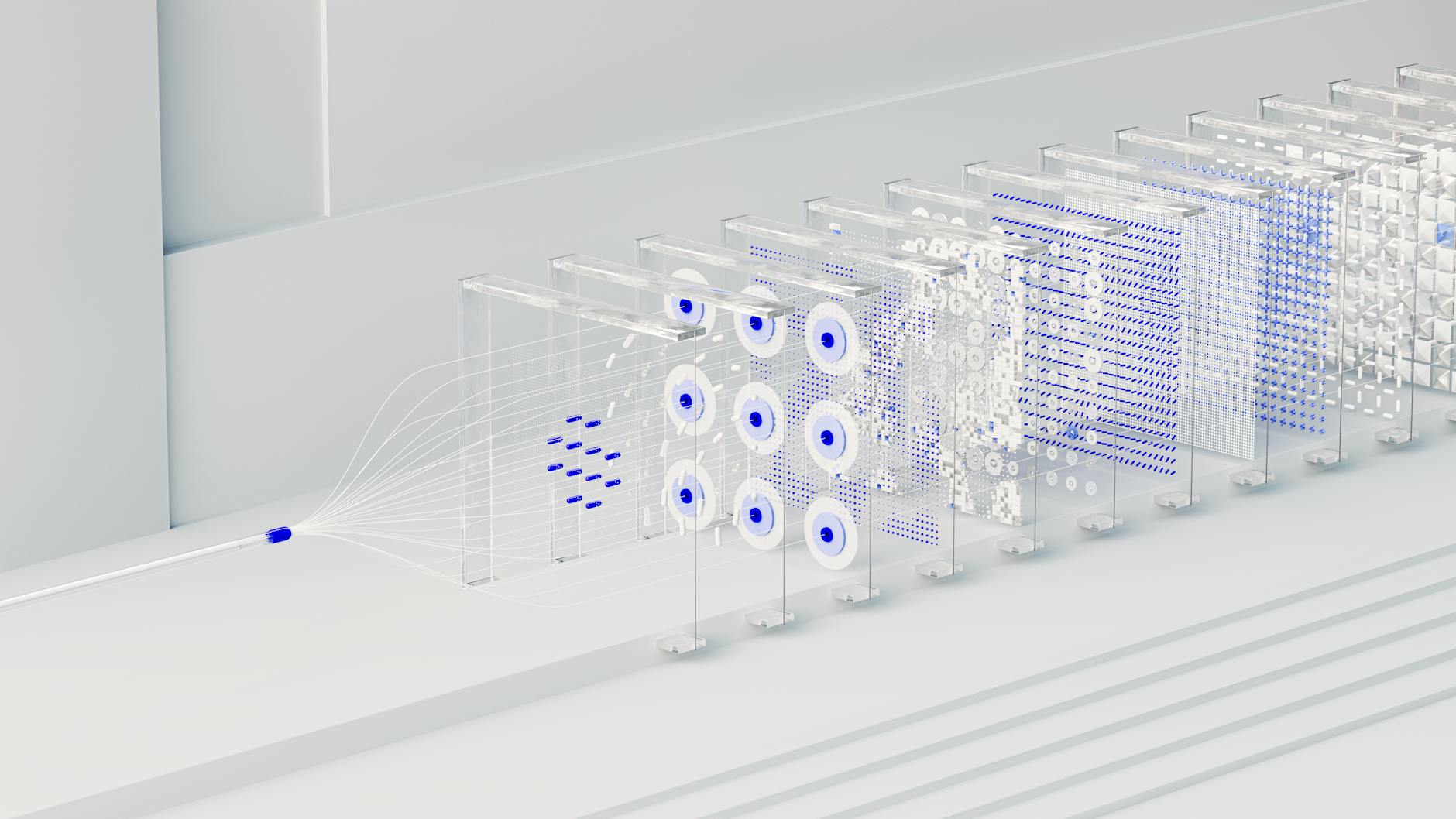

The Role of Layer 2 Scaling Solutions

One of the most promising solutions to Ethereum’s scalability woes is the adoption of Layer 2 (L2) scaling technologies. These systems operate on top of the Ethereum mainnet, offloading heavy computational processes while still ensuring the reliability and security of the blockchain’s Layer 1 foundation.

1. Optimistic Rollups

Optimistic Rollups, such as those enabled by Optimism and Arbitrum, shift transaction computation off-chain. Instead of validating every transaction on Ethereum’s mainnet, Optimistic Rollups assume that transactions are valid by default and only check their validity when a dispute arises. This system allows thousands of transactions to be processed in batches, reducing congestion significantly.

However, withdrawals using Optimistic Rollups are typically delayed due to a mandatory dispute resolution window (usually around seven days). While this delay can be inconvenient, the security trade-off ensures that fraud is minimized.

2. Zero-Knowledge Rollups (zk-Rollups)

Zero-Knowledge Rollups are another innovative L2 solution. These use cryptographic proofs, known as succinct non-interactive zero-knowledge proofs (SNARKs or STARKs), to validate transactions off-chain with immediate finality. zk-Rollups compress a large number of transactions into a single batch, posting proof to the Ethereum mainnet to confirm the validity of the operations.

Projects like zkSync and StarkEx are leading examples of zk-Rollup technology. Compared to Optimistic Rollups, zk-Rollups are faster and often have lower gas fees, making them ideal for scaling solutions where speed is critical, such as gaming or payment platforms. However, they’re generally more complex to develop and have faced challenges around compatibility with Ethereum’s Virtual Machine (EVM).

Why Layer 2 is Key

Layer 2 solutions provide a much-needed lifeline for reducing gas fees and improving user experience. By bundling multiple transactions into a single proof, these systems alleviate the pressure on Ethereum’s mainnet while maintaining decentralization and security. For instance, zk-Rollups reduce costs by up to 99% in some cases, potentially democratizing blockchain access for smaller, non-institutional users.

Ethereum Improvement Proposals (EIPs) and Their Progress

Ethereum developers have introduced several Ethereum Improvement Proposals (EIPs) designed to enhance scalability and reduce gas fees. EIPs are technical standards aiming to address protocol inefficiencies or introduce new functionalities. Here’s a quick overview of the relevant ones:

1. EIP-1559

Implemented in 2021, EIP-1559 was a game-changer for Ethereum gas fees. It introduced a dual-fee system comprising a base fee and an optional priority tip. The base fee is algorithmically adjusted based on network demand and burned after each transaction, reducing ETH’s circulating supply. This upgrade aimed to improve fee predictability and reduce volatility, though it hasn’t completely alleviated high fees during congestion.

2. EIP-4844 (Proto-Danksharding)

EIP-4844, currently in development, introduces data blobs, an innovative way to handle large data payloads. These blobs allow for more extensive transaction batches, significantly lowering gas fees for rollups. Often referred to as Proto-Danksharding, it’s seen as a stepping stone toward Ethereum’s full sharding implementation, which is expected to further increase scalability by dividing the network into multiple “shards” or sub-networks.

3. EIP-4488

While EIP-4844 focuses on long-term scalability, EIP-4488 targets immediate cost reductions for rollups by lowering calldata gas costs. Calldata—a component of Layer 2 transaction proofs—adds to gas fees when rollups submit proofs to the Ethereum mainnet. This proposal reduces that expense, allowing rollups to operate more affordably.

Other Upcoming Improvements

Ethereum’s path to scalability also includes the gradual onboarding of features like state expiry, which would prune inactive data, and other optimizations in validators’ operations. As upgrades like Dencun roll out, we can expect incremental fee reductions, making L2 technologies even more effective and accessible.

The Way Forward

Ethereum’s network is evolving faster than at any point in its history. Between sophisticated Layer 2 solutions such as zk-Rollups and Optimistic Rollups, and critical EIPs refining how the network functions, the roadmap for Ethereum scalability looks promising. While challenges such as rising demand from DeFi, gaming, and AI persist, these innovations underscore a collective effort to future-proof the blockchain.

Conclusion

The surge in Ethereum gas fees underscores the challenges of balancing growth and accessibility in a high-demand ecosystem. AI-powered gaming, alongside memecoin frenzies and a rebounding DeFi sector, is driving this unprecedented network strain. However, the ongoing adoption of Layer 2 solutions and forward-looking upgrades like Proto-Danksharding offer a path to a more scalable future.

Ethereum’s ability to adapt through innovation highlights its role as a cornerstone of blockchain advancement. Users and developers alike should remain optimistic as these changes aim to bridge the gap between cutting-edge technology and everyday usability, ensuring Ethereum’s continued relevance in an evolving digital economy.

1 Comment

zoritoler imol

I don’t even know how I ended up here, but I thought this post was good. I do not know who you are but definitely you are going to a famous blogger if you are not already 😉 Cheers!